Introduction

The "Leasing as a Service" product is meant to provide a complete set of services that lets partners embed the leasing process in their own commercial process, from the simulation of financing options to the activation of the contract.

It is based on a standard API and notifications approach, fully documented on this portal.

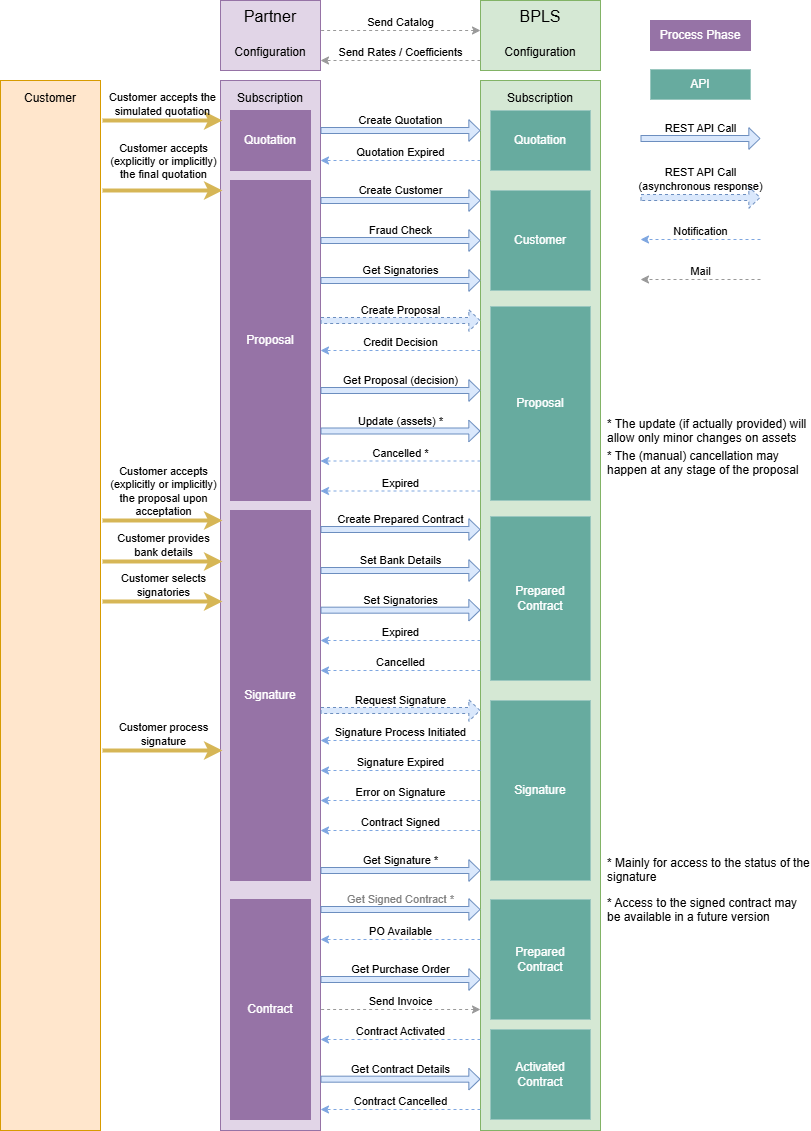

Overview of the LaaS interaction model

The leasing process is separated in 5 different phases:

- Simulation: different financing scenarios can be evaluated in real-time on the partner platform (with reference data provided by BPLS).

The simulation is separate from the quotation in the sense that the former is not fully committed by BPLS, although the solution proposed should be identical to what will come out with a formal quotation.

- Quotation: once the end customer has selected a financing scenario, with the best conditions for her needs, the final quotation (with definitive commitment from BPLS) is processed on the BPLS platform.

Although, in some cases, the quotation may depend on conditions reserved to a specific client, it is not mandatorily associated with one. Once the client has accepted the final quotation, its details must be provided in order to submit it to the BPLS decision engine, during the proposal phase.

- Proposal: with the addition of the customer information, the quotation becomes a proposal, submitted for credit decision. This process, which involves several eligibility checks on the client itself as well as on the requested financing operation, is asynchronous as it may take some time, depending on various factors.

When a decision is reached, it is pushed to the partner to transmit to the end customer, who, in case the request has been accepted, may then trigger the contracting and signature process.

- Signature: if the financing request is accepted by BPLS, a contract is prepared, with additional information such as the signatories and bank details which have to be provided at this stage, to be signed by the end customer.

The electronic signature process is handled by a third-party and embeds a mandatory digital identification and authentication of the signatories. It is asynchronous, as it usually takes some time to gather all the required signatures. The result (success, error, validity expiration...) is notified to the partner, to be reported to the end client.

- Contract: when the signature is completed, the contract is finally "activated". Its full details, including the final payment schedule, may be retrieved.

Tags